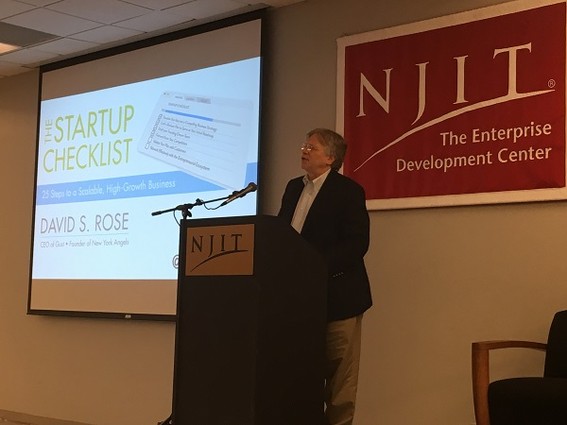

At NJIT EDC Venture Summit, Angels David S. Rose and Greg Olsen Talk about Their Journeys

The NJIT Enterprise Development Center held its annual EDC Venture Summit on Oct. 21. The event, which attracted some 200 people, featured keynote addresses by angel investors David S. Rose and Dr. Gregory H. Olsen.

The EDC also highlighted its member companies during the summit, as well as the companies that had participated in the New Jersey Innovation Institute Health IT Connections cohort.

Rose is founder and chairman emeritus of New York Angels and is the founder and CEO of Gust (New York), a platform that brings entrepreneurs and investors together.

Olsen is the president of GHO Ventures (Princeton), and has had a unique career path that involved building a tech business called “Sensors Unlimited,” selling it, buying it back and then reselling it. And he has the added distinction of having traveled into space as a guest of the Russian space program.

Rose gave the first keynote, beginning with his background and stating that he has been a serial entrepreneur since age 10. He then talked about his father, Daniel Rose, who was also an entrepreneur, and a great uncle who was an angel investor before that term was coined.

He has been both an entrepreneur and an investor; and he told the audience that, as an investor, “I have a whole lot of empathy for the people on the other side of the table.” Angel investing has given him access to a lot of fun things and people, he said, including being asked to host an online reality show called “Second Chance,” in which he worked with entrepreneurs who had failed with their first businesses; the entrepreneurs also competed for a prize of $150,000, which would go toward making their second businesses a success.

After founding Gust, Rose wrote a book on angel investing that was aimed at the angel investor community. It made the New York Times best seller list, he said; but Wiley, the publisher couldn’t figure out who was reading it, as there simply weren’t that many angel investors around. It turned out that entrepreneurs were reading the book to get insights into how angels looked at their companies.

Rose’s latest project is a book called The Startup Checklist: 25 Steps to a Scalable, High-Growth Business which answers the question, “How do I design a business from the beginning to be a high-growth business?”

The vast majority of businesses are not high-growth, he said. But if you are a business that is fundable, you have to be in “constant growth mode; the business will always be growing.” For the entrepreneur, the value you are creating is the equity in the corporate entity. “That value in the entity, the business, only gets realized for yourself and your employees at the point where that you have an exit.”

Olsen, who was also an entrepreneur before he became an investor, went through his entrepreneurial history, noting that his first company, EPITAXX (Trenton), a fiber-optic detector manufacturer, was sold in 1990 for $2 million. The company was sold again, after he left it, to a large company. “At that time, EPITAXX employed 1,000 people. I kind of think that that’s what entrepreneurship is all about,” he said.

His next company, Sensors Unlimited (Princeton), used the same fiber optic detectors, but in this case, “we arrayed them into linear or two-dimensional arrays for applications like night vision” or for looking for ice on airplanes.

“We also started with SBIR [Small Business Innovation Research] contracts,” Olsen said. “Anyone who doesn’t know what these are, make sure you find out, because you can get up to a million dollars of free cash that you don’t have to pay back, and maintain all the patent rights for whatever you develop.” The company made commercial cameras, and by 1998 had significant sales in the communications industry and was turning a profit.

The year 2000 was a crazy year, he said. “If you mentioned the words “fiber optic” or “telecom,” you were easily worth ten times more than last week. That’s when Sensors Unlimited was acquired by Finisar Corporation (Sunnyvale, Calif.) for the equivalent of $600 million. “The market then crashed, and two years later we bought ourselves back for $6 million.” Olsen and his team rebuilt the company, and three years later sold it again, this time for $60 million in cash.

He noted that, while this may make him seem like a “wheeler-dealer,” in fact he wasn’t one. The company was bought by Finisar for 20 million shares of Finisar stock, which at that time was about equal to $600 million.

“In the year 2000, everyone knew that stock was worth more than cash,” Olsen said with some regret. “That was just like in 2007, when everyone believed they had to buy a second or third house.” When Olsen bought the company back, the stock was only worth about 50 cents, he noted.

While economic cycles continue to fluctuate, the one thing that doesn’t change is what Olsen called “leverage, the ability to trade one thing for another.” His company was in the semiconductor business, which requires millions of dollars’ worth of equipment to create products, he said; and Sensors Unlimited didn’t have that kind of cash.

Olsen recalled that a friend of his had brought some equipment from the University of Southern California to Princeton University, but didn’t have anyone to set it up. “It was a match made in heaven. I helped him set up the equipment with my engineers, and they let us use the equipment to do our R&D contracts.” That helped the company get going at minimal cost.

Olsen noted the most valuable thing he’s currently doing is networking. “I think it’s important to share whatever experience I have; but, also, there may be a new investment, there may be a new employee. I never know.” He encourages students to network. “To this day, I don’t really get involved with anything financial,” he said. “But I know people who do, and do it very well. And by having relationships with them, I can solve that part of my business.”

He also gave some advice to people who want to sell their business. “Just like 2008 and 2009 wasn’t a good time to sell your house, you can’t force the market. But what you can do is be ready. …The same thing with companies. If you have a good management team in place and a nice presentation, you’ll be ready for when opportunity swings back, which it invariably does.”