Want to Know How Covid-19 is Shaping Online Consumer Behavior? NetElixir has Answers

NJTechWeekly.com recently conducted an email interview with Udayan Bose, founder and CEO of NetElixir (Princeton). The company is well known for its smart algorithms that track consumer online behavior, and has been conducting webinars for its customers to discuss its research on changing buyer behavior in the face of the coronavirus pandemic. We wanted to know what trends the company is seeing during these uncertain times.

Tell me about your company.

UB: NetElixir is a Princeton-based digital agency that offers digital marketing and e-commerce development services and technology solutions for the retail industry. Since 2005, we have helped over 500 retailers in the U.S. and Europe grow their e-commerce sales through our digital marketing solutions.

Tell me more about the research that NetElixir has been doing?

UB: We have been conducting ongoing research since August 2008 on e-commerce sales and online shopper behavior for various retail categories. The goal of our research is to use our proprietary customer analytics platform, LXRInsights, to analyze and better understand the impact of various factors (economic, seasonal, technological, cultural) on how customers “search, shop and buy” products online.

Never, ever have we faced a situation like what is being experienced currently amidst the coronavirus outbreak. We have been tracking the impact of this outbreak on e-commerce sales and online shopper behavior since the third week in January. The questions that we are attempting to answer using the data are grouped into two categories: (a) the e-commerce sales impact across seven retail categories, and (b) online shopper behavior.

Where is your data coming from?

UB: We are aggregating real-time e-commerce sales, as well as the customers’ path-to-purchase data for our current research on the impact of coronavirus. The data comes from the e-commerce sites of mid-size and large retailers in the following retail categories: food, gifts, home furnishings, apparel, home improvement, pet supplies and tools and hardware. The data is analyzed using our customer analytics platform, LXRInsights.

What industries are you seeing most impacted by the coronavirus?

UB: All industries are impacted by the outbreak. Categories like food and groceries have experienced panic-buying sales lifts and have seen a big jump in the sales coming from first-time online shoppers. Other categories, like hobby products, gifts, home furnishings, pet supplies, home décor and DIY tools, are also experiencing high double-digit year-on-year growth in online sales. Categories like audio equipment, restaurant supplies, etc., are taking a hit.

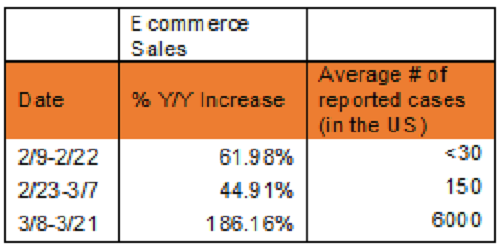

Are people buying more online? Do you have any data that supports this?

UB: Our data shows an increase in online sales for most of the categories. As is to be expected, the essential product categories like food and groceries are experiencing massive increases in online purchases (over 100 percent). See the example below from the food category.

Based on what you have seen, do you think there will be long-term changes in the online shopping behavior of customers?

UB: We are seeing many first-time online buyers. Their average initial purchase size is smaller than regular buyers’. As these buyers get more accustomed to buying online, they can be expected to spend more per purchase. Retailers will need to carefully analyze the purchasing behavior of these new buyers and continually lower the purchase friction. Once things are back to normal, many of these shoppers may return back to their favorite brick-and-mortar stores. However, a certain percentage of shoppers will continue to buy online. In 2019, online sales accounted for just 16 percent of total retail sales. This outbreak may change that skew towards online in 2020 (maybe to 20 percent or more). Also, even if the shoppers migrate back to offline stores, their level of comfort with engaging in online shopping would have gone up substantially. This again will be very helpful in driving up online sales.

How is coronavirus influencing online shopper behavior?

UB: There are three key areas where coronavirus is impacting shopper behavior: lower first purchase latency (the interval between the first time a visitor lands on website and when she makes the first purchase has gone down by 22 percent); and quicker purchase completion. Repeat purchase latency is also down by 16 percent. The percent of mobile purchases has gone up for most categories.

The average cart size has gone up marginally (about 8 percent). However, the number of items per order has increased by 12 percent.

We will be sharing regular insights and data through a series of webinars (https://www.netelixir.com/covid-19/), and will post regular updates on our blog (https://www.netelixir.com/blog/).

What would your advice be for retailer marketers?

UB: Here are my top three recommendations:

- Take care of your online customers. Use data to understand their behavior and market to them more responsibly.

- Lower the purchase friction on your website, so that customers can complete their purchases easily and quickly.

- Be creative with product-level promotions.

Is there anything I haven’t asked you about that you think is interesting and that you would like to tell me about?

UB: The coronavirus outbreak poses unprecedented challenges for businesses. Data-driven marketers that work with nimble, technology-focused expert digital agencies can come out of this crisis with flying colors. For others, the road ahead may be a lot more difficult.