At Newark Venture Partners Demo Day, Katz Announces NVP 2, a Second Fund

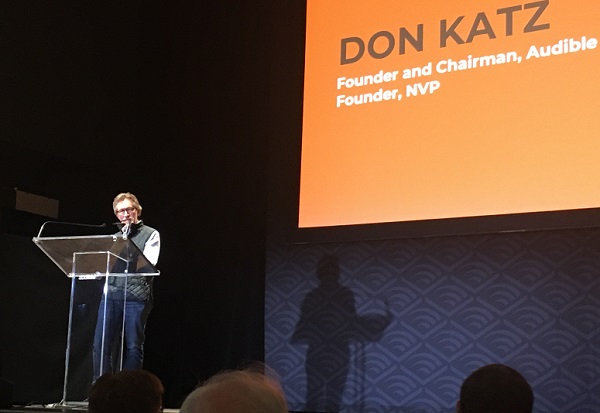

During his speech at NVP Labs Demo Day, on January 15, the actual date of Martin Luther King’s birthday, Don Katz, founder of Newark Venture Partners (NVP) and founder and executive chairman of Audible (Newark), announced that NVP would be raising a second fund.

“Now it’s time to double down on NVP’s success,” he said. “NVP is raising $100 million for NVP 2.”

Audible will invest $20 million in NVP 2. RJWBarnabas Health (Short Hills) will also be an investor, along with the Geraldine R. Dodge Foundation (Morristown). “I’m thrilled that the Dodge Foundation has committed to a groundbreaking level of investment by any nonprofit” in Newark’s future, he said.

Katz recalled how he had struggled to get Newark’s corporations to buy into Newark Venture Partners’ first fund, with its double bottom line, to spawn profitable companies and contribute to Newark’s tax base and employment by creating a startup ecosystem. However, one by one, corporations headquartered in and around Newark came on board, and the founding of NVP was announced in 2015. Now the focus is on those partners joining NVP 2.

“The mission for Audible and the other contributors to NVP 2 is to significantly ratchet up the strategic innovation value for their core businesses with NVP 2,” Katz continued.

It’s no accident that NVP’s pipeline is so rich with patient-facing and healthcare-tech startups, given the strategic partnership between RWJ Barnabas and Horizon Blue Cross Blue Shield of New Jersey (Newark). “Fintech startups would reflect the focus and innovation needs of Prudential and TD Bank,” said Katz.

“NVP 2’s leadership would create programmatic opportunities for companies to create new models to leverage minority, majority and even M&A [mergers and acquisitions] with high potential startups,” he noted.

There are also “exciting plans to make sure there is plenty of reasonably priced peer coworking space for NVP companies” to expand. In addition, Ben Korman, chairman and CEO of Lotus Equity Group (New York), and “our friends from L&M [Development Partners] are creating exciting places to live close by to NVP and Audible in what I hope will soon be renamed ‘the Washington Park district.’”

When NVP was founded, Katz said, the vision was that larger investors in the fund would include operating companies that could also contribute to Newark Venture Partners in new ways — beyond just dollars. The idea differed from the concept of “captured” venture funds, in which one company creates a fund and an incubator, often turning off many founders because of the limited help the companies could receive and the restricted single-exit strategy.

The idea was that an array of companies would contribute a lot of subject-area expertise, from advanced technologists who could advise on design to talent-acquisition professionals at the top of their game, he said. Over the years, NVP portfolio companies have had access to over 500 portfolio company executives.

Dun & Bradstreet (Short Hills), when it was led by Bob Carrigan, (now the CEO of Audible), figured out how to tap into D&B’s pension fund to invest in the original NVP. That company sent a team of 40 “young and gifted data scientists” to coach and help refine the portfolio companies’ business plans.

Katz also discussed how he was championing a bill that would allow the state to pay the cloud bill of companies that move into Newark, Paterson, Camden and Trenton.

After Katz’s presentation, New Jersey Assemblywoman and Assembly Budget Chair Eliana Pintor Marin said that she had introduced legislation that would have the state “appropriate $25 million to NVP’s $100 million second fund.” She said that she realized it was only a small piece of the pie. But, she added, all she can do is fight every day for what “the city of Newark deserves.”