Attention Startups: Newark Advances Its Quest to Be a Tech Hub

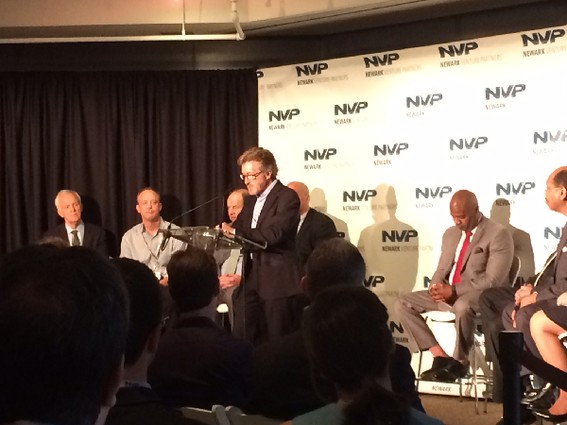

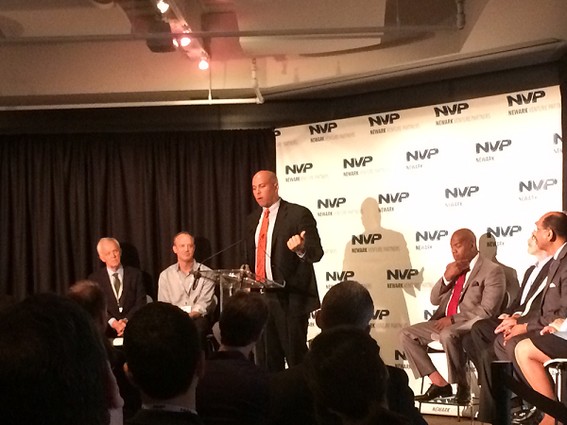

Addressing a passel of dignitaries committed to helping Newark become a technology destination, Audible founder and CEO Donald Katz announced the formation of Newark Venture Partners (NVP), which will manage a $50 million early-stage venture fund and a 25,000-square-foot accelerator at One Washington Park that will incubate new companies and nourish partially formed ones.

Simultaneously, the City of Newark unveiled its new Firebolt Wi-Fi, an outdoor, lightning-fast free public network funded by the Military Park Partnership, Audible and Prudential Financial. Firebolt covers a two linear mile stretch of downtown Newark and extends to several community recreation centers and housing authority locations in the city’s neighborhoods.

NVP and its backers are banking that the pull of substantial dollars; the lure of high speed Wi-Fi; an advanced fiber-optic infrastructure providing 10 gigabits to the accelerator floor; close proximity to New York and public transportation; and high profile mentorship that currently includes Kleiner Perkins partner Bing Gordon, Union Square Ventures partner Brad Burnham and noted early-stage investor Oren Zeev will create enough buzz to entice companies to Newark.

Startups will also have help from Audible employees; access to Rutgers Business School professors and students; Amazon.com cloud tools and expert advice; and a beautiful new (and rent-free) 25,000-square-foot space.

Officials are hoping that, once in Newark, some of the startups will decide to stay, grow and create jobs, as Audible, which is owned by Amazon, admirably did.

What was unusual about the press announcement, on July 20, 2015 at Audible’s headquarters, was the unique cooperation that was evident at the event. Politicians — Republicans and Democrats — sat on the same stage with representatives of Newark’s business community and clergy. The audience included educators, members of Newark’s tech community, Meetup organizers from around the state, influential New Jersey angels, and representatives of the New Jersey Economic Development Authority.

NJTechWeekly spoke to Thomas Wisniewski, NVP’s managing partner, after the event. He told us that about half of the $50 million fund had already been raised, without the help of the New Jersey state government.

“We secured the minimum threshold that we could get to, and once we achieved that result we turned our attention to creating the infrastructure,” he said. “We are going to use the publicity to find that additional group of partners.” Wisniewski later pointed out that Amazon and Prudential were the primary investors in the fund, and added, “We have signed agreements with a third. Two more are imminent. These additional investors are all Newark-area family offices, philanthropists and prominent business owners.”

Wisniewski said that he expects to find portfolio companies in New Jersey, rather than just poaching companies from New York. But, “we expect to be a draw for companies from all over the world. We already have linkages to investors and startups in Israel and other places that are thriving. There are people in other parts of the country that see the New York area as a great place to come and they will come directly to us.”

The fund is also doing some outreach specifically aimed at New Jersey. On the same day as the announcement, Wisniewski told us, “We hosted a lunch for some 40 venture investors in the New Jersey area, as well as the heads of all the meetups. So, absolutely, we are doing our best to connect in to what’s here already.”

Certain types of companies will be drawn to Newark’s special advantages, for example e-commerce companies, which are booming in New York, and digital media or video companies that need lots of bandwidth, said Wisniewski. “We will be tapping into that clustering idea,” he added. “We’d like to get five companies all about the same stage that are doing e-commerce,” for example. “They’ll learn from each other and we will bring to them the greatest resources” that will help an e-commerce company get off the ground.

“We plan to begin piloting with a few companies,” in the accelerator, and to begin “formally recruiting for our first class immediately when we open the space in October.” Wisniewski anticipates the first formal accelerator class to start in the first quarter of 2016.

The identification of NVP as a social impact fund with a “double bottom line” was a bit confusing to some of those attending the announcement. Actually, the fund is not going to be made up of companies with a “social good” agenda. Instead, it will be measuring the good that comes out of the economic growth generated in Newark, including the jobs created as it evolves, and will make that information transparent.

“We can do best-of-class venture capital investing, finding the best companies, ones that are going to grow as soon as possible, and help them succeed. As long as we can do that on the ground in Newark, and we put together a package that will be attractive, jobs will come here, companies will come here, foot traffic will come here and Newark will benefit,” Wisniewski said.

Wisniewski also expects the accelerator to change the public’s and tech community’s negative perceptions of Newark.

“Right now, if you asked people ‘How would you rate Newark as a place to do technology and business?’ you probably wouldn’t get too high of a score. We already know where that score is today and we are going to measure it every year. We want to have a positive impact on the companies we are bringing to Newark, but we are also cognizant of trying to change the Newark brand.”

According to Wisniewski, the fund will be operating in three stages: pre-seed, seed and Series A. “Pre-seed would be one person with a prototype or an idea developed with their own capital or friends and family. We will be investing tens of thousands of dollars, maybe $50,000 up front for the larger ones, and ten grand for the really early ones, and we are going to try to graduate those companies into seed rounds.”

Seed rounds would range from $250,000 to $1 million. “We are looking to attract companies that would come directly to us into the seed round, and then upstream from that is the traditional Series A, $3 to $5 million.” Companies already in the fund would have an opportunity to receive follow-on financing, but the fund would also bring in new companies at that level, he said.

“By having the companies here, they will have daily access to us, their peers and mentors,” Wisniewski said. He added that he’ll be able to help companies overcome their problems, whether it’s finding their first customers or a key engineer. And, as an experienced fund manager, he said he knows the hurdles companies face at various stages, so he and his colleagues will be able to help them.

Wisniewski has not set the amount of equity the accelerator will be taking from companies that join, but he said it would probably be within the typical accelerator model, with a 6 to 8 percent stake in the company in return for a $50,000 investment.

“I think there is a lot of opportunity in the accelerator space, but it’s not about recreating Techstars. …We want to take their graduates, we want to take their alumni. Just because you are in a program for three months, it doesn’t mean you are done with needing help. I would hope to take a graduate of Techstars or ERA out of every class. … I also want to look earlier. I think there is an opportunity to do pre-seed funding,” as 500 Startups is doing in its programs. “I think that’s amazing. …We could use very small amounts of capital, one to ten grand, and not ask for much in return, maybe just the right to be an investor later on.”

He added that NVP wants to hear from all companies in the stages of development up to Series A, and he urges startups, mentors, investors and sponsors to go to NVP’s website and sign up.