New “Montclair Starts Up” Series Features Startups, Investors at In-Person Meetings

Montclair entrepreneurs, investors and business school leaders unveiled a new series of meetings in Montclair and surrounding towns to help local startups pitch proposals, raise money and make connections.

The Montclair Starts Up event series has all the ingredients for generating startup success stories in the Montclair area, leaders promoting the event said during the meeting.

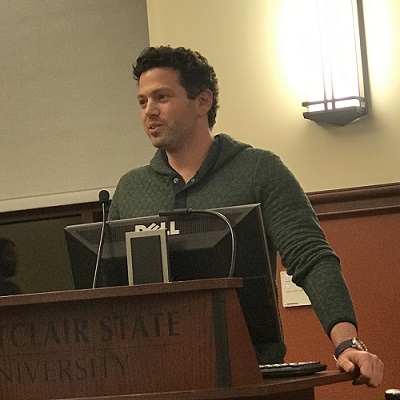

“For everyone who helped put this event together, we answered the first question entrepreneurs have to ask: Does anybody want this? All of you showing up today is proof that there’s excitement for it,” said Zack Rosenberg, a Montclair entrepreneur and the event emcee.

The first event of the series, held on February 15, drew about 100 people to Montclair State University’s Feliciano Center for Entrepreneurship and Innovation. The next meeting is scheduled for April 12, and will focus on how to launch and scale up product-based companies.

Rosenberg is the cofounder and CEO of Qortex, a Montclair firm that pioneered on-stream, scalable in-video advertising solutions for the web, connected TV (CTV) and games that match messages to moments through artificial intelligence (AI). At the first meeting, he told the attendees, “Entrepreneurship is incredibly difficult. I’m going to share a secret: The secret is community, and that is the theme of this evening. We are finding the resources we need right here in our own backyard, and we didn’t know they existed. That didn’t happen in a pre-COVID world. Hopefully, it happens in a post-COVID world.”

Feliciano Center For Entrepreneurship and Innovation

Liz Rich, acting director of the Feliciano Center For Entrepreneurship and Innovation, and Valeria Aloe, director for strategic development, said that the series was created to bring together businesses in the surrounding communities, as well as investors, experts and students to discuss and share best practices on topics relevant to the launching and scaling up of an idea or business.

“Through this event, we invited entrepreneurs to pitch their ideas, we hosted a panel of experts on venture capital and allowed time for networking and community building. The attendance and engagement exceeded our expectations, and we look forward to continue offering this series in the future to promote a sense of community and collaboration, and to [help] Montclair State University accomplish its strategic pillars of public service,” Aloe said. Register here for the April 12 event.

Through a partnership with the New Jersey Small Business Development Centers, individual mentorship and training sessions will be available to both established and new small to midsized businesses, as part of the center’s “Ignite Entrepreneurs’’ program. The sessions will include topics such as business planning, branding, accounting, credit repairing, sales and marketing, fundraising, search engine optimization and scaling up, she added.

Startups Presenting

During the meeting, two startup founders from the Montclair area made their pitches, and Rosenberg spoke with a panel of three local venture capitalists about issues that business owners should keep in mind. The two startup founders were:

- Tres Williams, CEO of The Rights, an early-stage company developing technology to simplify music licensing.

- Gene Gurkoff, CEO of Charity Miles, who is looking to create a new startup, which would focus on walking during business meetings.

Williams was previously the executive vice president of business affairs at iHeartMedia (New York), responsible for strategic dealmaking with the music and entertainment industries from 2011 through 2020.

“I became obsessed with solving this problem: Video creation has exploded and so was the need for music in those videos. I would attribute that need to podcasts and games, the other creative worlds that use music. To legally use that music, you need to obtain a license,” he said.

“There’s no central place to get that license, and there are multiple owners who own the music. Typically, the number of owners of a song is seven. There are six music publishers and the owner of the recorded music copyright typically on the song, so you have to go to negotiate with all those parties, and there is no central place to do that today,” he said.

“Our solution: We’ve created the first-ever central location where we can bring buyers and sellers together in an efficient way. And it’s driven by AI. We built AI tools that help us handle that sort of busy

workflow,” Williams said.

Gurkoff’s idea hasn’t become a business yet, but it’s similar to his existing app, Charity Miles, created 11 years ago, which allows people to raise money whenever they walk, run or bike or engage in other activities.

His latest idea combines walking and holding meetings. “Everybody wants to help encourage their employees to walk and create a culture of walking within their company,” he said.

Investor Panel

The investor panel — including Joe Apprendi, cofounder and general partner at Revel Partners (New York); Daniel Roever, managing partner at Boro Capital (New York); and Tina Philip, managing partner and COO at Full In Partners (New York) — weighed in.

The investors said that venture capital is a risky business. They advised startups to be careful not to grow their businesses too fast. Also, they said, finding fundraisers in the second and third rounds is becoming another concern for founders.

The investors said that finding passionate founders is critical. Apprendi noted that “a big passion is dependent on your background, independent of your expertise. You have to be committed. You have to

be tenacious.” But 90 percent of that investment decision is the founder’s cofounding team, [which is] independent of your ideas, independent of your traction,” Apprendi said.

Roever said, “Having passionate founders is great and helpful, and almost essential. But sometimes that will lead to them being a little myopic, and they see their world and they don’t quite understand that there is either more to that idea or that it’s just too little of an idea.” He added, “We like to invest in companies that already have a certain level of traction. … If they don’t have experience and they don’t have traction, and they only have passion,” it gets a little trickier to invest in them.

Philip noted, “The passion has to be there with the product … so the founder is able to build a team around them that can take that company to the next level. “You might have a really great idea that’s solving a problem in the world. And you might be really good at creating ideas or [ identifying] problems, but not necessarily at running a business as it gets to scale. So that’s where we’re assessing your team, to see [if you] have built a group around you that can support all of the functions that are going to come when your idea becomes a 500-person organization.”