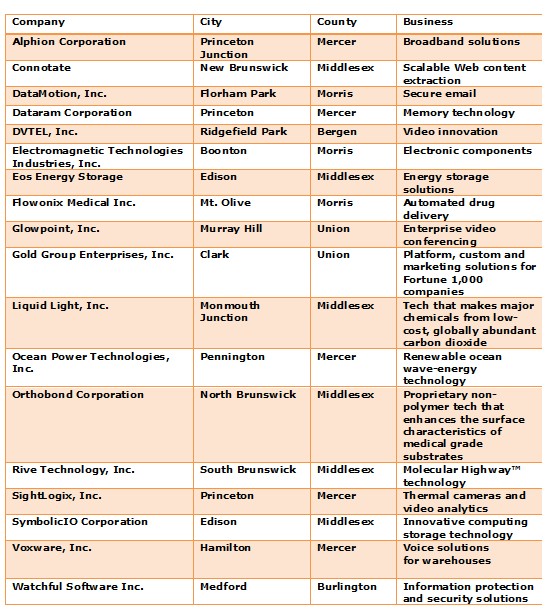

18 NJ Tech Firms Take Advantage of 2016 Business Tax Certificate Transfer Program

Each year, the New Jersey Economic Development Authority (EDA) announces the names of the companies that have been approved to share in the funding for the Technology Business Tax Certificate Transfer Program, known as NOL, for the next fiscal year 2016.

This year, 18 companies classified as tech are on the list. The companies approved this year will receive an average of about $1.16 million. Some 41 applicants were approved to share in the $47.4 million allocated to this program. Last year’s applicants shared $54 million. This year’s list of all those selected, including biotech firms, can be found here.

In essence, the NOL program lets biotech and other tech companies with protected intellectual property sell their New Jersey tax losses and/or research and development tax credits to raise cash to finance their growth and operations. An informative presentation of all of the program requirements can be found here.

The EDA said in a statement that since the program was established in 1999, more than 500 unique businesses have been approved for awards totaling $860 million.

Five companies are participating in the NOL program for the first time in fiscal year 2016. Of the participating companies for 2016, 21 have previously participated in other programs offered by the state, such as the Angel Investor Tax Credit Program.