Blockchain Could Be “Existential Threat” to Middlemen, Sorin Says at Asbury Agile

For the average investor unable to buy into the diamond, fine art or real estate markets, blockchain technologies are changing the game, giving them a long-awaited green light.

Blockchain basically allows two ends of a transaction to deal directly with each other, eliminating the middlemen.

That is putting plenty of people in the middle on edge, said David Sorin, an expert in blockchain technology and office managing partner at the law firm McCarter & English (East Brunswick).

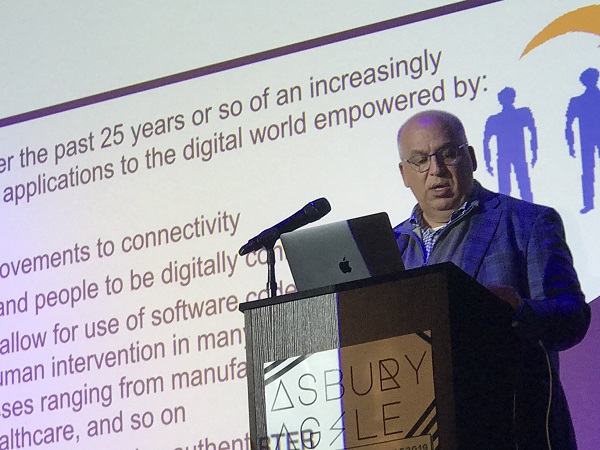

Sorin spoke at the ninth annual Asbury Agile conference, which took place October 4 in Asbury Park. Asbury Agile is a friendly, informal, single-track conference for technology professionals and students.

More than 200 people attended the event, organized by cofounders Kevin Fricovsky and Bret Morgan. This year, the organizers added Jenna Gaudio, VP of product management at Vydia (Holmdel), as an emcee.

Attendees heard from several tech authorities on such topics as “Collaboration in Theory and Practice” and “Managing Through Chaos.”

Sorin discussed how blockchain technology could end the need for middlemen.

“There are many who believe that blockchain, taken to its logical conclusion, represents an existential threat to middlemen and banking in particular,” he said. “Middlemen will cease to exist if they cannot demonstrate that they add value beyond their movement of goods and services or finances throughout the supply chain.

“The banking industry recognizes the threat. We are still going to need access to capital. We are still going to need private equity venture capital. But the very people who run those organizations — the private equity funds, venture funds and banks — may no longer be the primary gatekeepers,” he said.

“Middlemen will cease to exist if they cannot demonstrate that they add value beyond their movement of goods and services or finances throughout the supply chain.” David Sorin at Asbury Agile

“There are people who believe these innovations are capable of triggering massive disruptive forces that will impact basically all sectors. The business community and the financial community specifically are bracing for that,” he added.

Sorin is a nationally recognized authority not only on blockchain, but also on smart contracts and digital currencies, emerging growth companies, privately and publicly owned startups, early stage companies, middle market technology and tech-enabled and life science enterprises.

Sorin’s talk included a brief history lesson on the evolution of blockchain technology, turning the clock back some 25 to 30 years, “starting with increasingly rapid movement of business and personal applications to the digital world.

“There were advances in software, leading to massive increases and overall improvements to connectivity largely as a result of deregulation in the telecommunications industry 30 years ago,” he said.

“Blockchain technologies have emerged that allow the use of software code to reduce and sometimes eliminate the need for human intervention in many business transactions, impacting underlying business processes ranging from manufacturing to distribution-logistics supply chains to finance and healthcare.”

The banking industry is doing all it can to remain relevant. It is among the important consumers of new fintech products because bankers want to ensure that they create customer interest and increased value through innovative products and services, he noted.

Democratized Access to Capital

Blockchain is helping entrepreneurs democratize large-asset investing by giving the average investor easier access to capital globally.

“That is the greatest near-term impact, the democratization of access to asset classes that heretofore would be unavailable to smaller investors,’’ he said.

“New ways to finance these assets create the ability for average people to invest in asset classes that they previously couldn’t have invested in before, thanks to blockchain technologies,” he said. Among these asset classes are diamonds, fine art and real estate.

“New ways to finance these assets create the ability for average people to invest in asset classes that they previously couldn’t have invested in before, thanks to blockchain technologies.” David Sorin at Asbury Agile

“There are new ways to finance real estate development projects using blockchain, instead of having developers go out and raise equity or borrow money and build projects one at a time. With blockchain, you have a far greater access to capital from a larger group of investors, including individuals, so we can develop more projects simultaneously.”

Sorin said that his firm is working with a fund for millennial investors who want to use blockchain technology to fragment each property on the market into small bits for purchase, something that would have been impossible under the old ways of financing.

“We are working with a company from Israel that is developing a platform so we can have a mechanism to invest in the diamond industry without buying whole diamonds,” he explained, crediting blockchain technology.

Sorin concluded, “Blockchain is not a panacea. It’s not for every business. It is not for every business process. But done right, with some of the industries we talked about it, it does represent a mechanism to dramatically increase the availability, dramatically reduce cost and — overused word — ‘democratize’ access for people, which would be good for economy in long run and good for the public.”

####