At Propelify, Speakers Debate Pros and Cons of Cryptocurrency and Blockchain

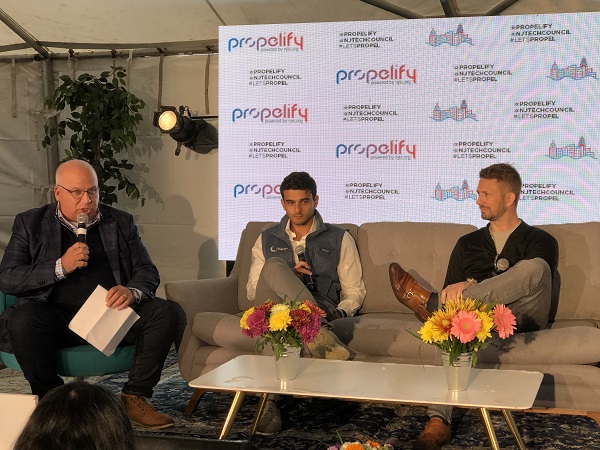

At the Propelify Innovation Festival held in Hoboken on October 3, panelists discussed the pros and cons of blockchain technology and cryptocurrency, including their impacts on the future of commerce and society.

The participants included Ali Hassan, cofounder and CEO of Crescent Crypto Asset Management (Jersey City) and Nick Adams, cofounder and managing partner of New York-based investment firm Differential Ventures. David Sorin, a partner at law firm McCarter & English (East Brunswick), was the moderator.

Hassan said that bitcoin and its underlying blockchain technology give people, rather than banks and governments, control of how money is used.

“Banks and governments have control over what we can do with our money.” he said. “Bitcoin removes that power from the entities that control the ledger, and gives it back to the people. That’s the true beauty and the only real use case today of blockchain technology. It’s the disintermediation of banking.”

Adams, however, disagreed with the idea that the replacement of the nation’s monetary system with cryptocurrencies has any merit. He cautioned that greater acceptance of digital currency still faces an uphill battle, particularly with government regulatory bodies.

“We will see World War III” before the U.S. fully adopts cryptocurrency, he said.

As for blockchain, there has been growing support for this technology because of its transparency, security and facilitation of investment in assets that only the wealthy could typically afford.

Hassan said that blockchain allows more people to invest in high-priced assets, such as big real estate projects and expensive artworks, which were usually out of their financial reach. With blockchain, the technology divides those assets into smaller pieces that are less costly to invest in. “This technology is beautiful and amazing. It can do things well beyond what we can imagine.”

Sorin added that his firm is currently working with an Israeli company that uses a blockchain infrastructure that enables investment in diamonds for those who “would not otherwise be able to invest in this asset class.”

While Adams likes some aspects of blockchain, he warned that the technology is not yet ready to be used in place of traditional ways of valuing assets. “There’s going to be a lot of pain and regulation before we get there.”