Meet Some of the Angel Investors Who Fund New Jersey Startups, Part One

The New Jersey Entrepreneurial Network’s annual Gathering of Angels, held on June 8, presented a rare opportunity for entrepreneurs to have short meetings with angel investors. Seven investors came to the meeting, representing themselves as well as several angel groups.

Prior to these meetings, in a “reverse venture fair format,” the angels briefly introduced their groups. They then provided some advice to the startup entrepreneurs at the event who were hoping to attract their attention. In this first part of a two-part story, we cover Mario Casabona, Jeff Snellenburg, Katherine O’Neill and John Pearlstein.

Mario Casabona

Mario Casabona introduced himself as an engineer first, then a serial entrepreneur, and then an active angel investor. Casabona sold an earlier company of his in 2004 to Honeywell, and today he’s the founder and CEO of Casabona Ventures. “I invest and actively manage an early-stage technology-focused fund, also referred to as a ‘micro VC’ fund. I currently have over 20 investments that I’m managing, including my own startup, TechLaunch [Clifton], which was New Jersey’s first technology accelerator.”

Casabona said that his investments typically range from $25,000 to $100,000, with “dry powder” to invest in follow-on funding rounds. Second-round financing is usually of the same magnitude, he said, and he’ll usually go in on a second round, but rarely on a third unless it is a very good company that has mitigated a lot of its risk.

Casabona likes to coinvest with other angels and angel groups. “The reason I do that is that it gives me some more quality deals.” It also expands the round size, he explained. So if he is investing $100,000, others can invest also, and the total round could be $500,000 to $1 million dollars.

His application process is simple, he said. “Just email me an executive summary,” and he will get back to the entrepreneur within 36 to 48 hours. Casabona said that his current focus is the Internet of Things because it is currently the hot sector and it’s of personal interest. [After this meeting, Casabona announced that TechLaunch will look at post-seed stage companies that are involved in the IoT.]

Advice: When investors say they’re working in the IoT, you are wasting your time talking to them about mobile apps. “For the entrepreneur, first it’s about the dream, and then it’s always about the funding. So, follow the money.”

Jeff Snellenburg

Angel Jeff Snellenburg wears several hats, as he represents the Mid-Atlantic Angel Group (Philadelphia), the PA Angel Networkand the Delaware Crossing Investor Group (Doylestown, Pa. and Princeton). Snellenburg said that he had started out as an entrepreneur, and sold a fire protection and security business in 2004. “I somehow got hooked into the early-stage capital markets.” Mid-Atlantic Angel Group has two institutional angel funds, both of which are fully funded and not making new investments. The PA Angel Network is a member-based organization with 18 angel groups, he said. The group works with representatives from economic development organizations, higher education institutions and venture funds. “We try to work with angel groups on best practices and to syndicate deals.”

Delaware Crossing Investor Group is currently making investments. “We have about 35 investments that we’ve made. We operate very similarly to other angel groups. We are individuals and we have 35 members. We meet monthly. At any meeting, we probably have 15 to 20 of the members there, and we listen to two to three companies at that point. … We actually invest as individuals, on the low end $75,000 and on the high end $300,000.” Angels often have some “dry powder” left over for add-on investing. “Ten years ago, when we started investing, follow-on investing wasn’t as common, but I think people are investing less in the first round and saving some dry powder to invest in a second or third round.”

Advice: “Make it easier for the angel community by having your documentation in order. …We can move a lot quicker if you have documentation already in place versus having to try to put that together.” Delaware Crossing says that it completes due diligence in 30 to 60 days, but if the entrepreneur has to put all the information together and the deal drags on, the deal will sometimes fall through because the angels lose interest.

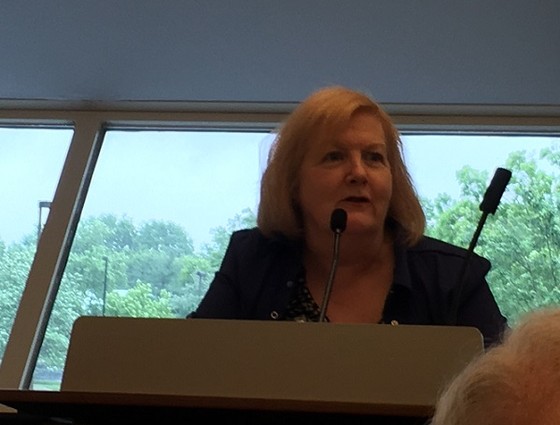

Katherine O’Neill

Katherine O’Neill spoke about both the Jumpstart NJ Angel Network (New Brunswick) and the Angel Capital Association (Overland Park, Kan.). The Angel Capital Association held a national conference in Philadelphia this year, she said, and some NJIT startups were represented at an innovation forum.

“It was a great chance to showcase the innovation in that occurs around here,” she said. “Essentially, between New York, Philadelphia and New Jersey, there is a big corridor of early-stage companies. We also know that the real, secret, dirty truth behind that is that there are many more companies that are deserving of funding, and there is so far less funding. Funding still is tight, and there is no easy answer to it.” She added that there are a lot of resources, including webinars and educational pieces for entrepreneurs on the ACA website.

The growth in angel groups has escalated as people want to know more about, and invest in, early-stage companies. “We are now in an innovation boom! There is no doubt about that. Things are changing faster and faster,” and the need for technology to boost that innovation continues to escalate. The ACA has 300 angel group members, “and one of the big values is the [deal] syndication that goes on between angel groups.”

O’Neill commented on the equity crowdfunding rules that have come to fruition recently allowing unaccredited investors to make equity investments. “I personally think it’s going to be a mess. It certainly may be attractive to your company, but the thing is you are dealing with people who may be unsophisticated. If you are an unsophisticated investor and you think you are taking a $1,000 ticket on the next Google,” you are in for a disappointment. She advised entrepreneurs to be cautious about going into the equity crowdfunding space. Regular crowdfunding is fine, she said. “Everyone, including angel investors, loves crowdfunding” for obtaining money to pay for the manufacture of a product. This kind of crowdfunding shows that you can move forward without equity dilution.

Jumpstart has been around for 13 years. It was originally formed by the New Jersey Economic Development Authority and New Jersey Tech Council. The group has 40 to 45 individuals who invest. “We will do $1 million by ourselves in a round, and when we invest, we do follow-on. If a company is hitting its marks and needs additional funding, we will follow on.”

The group has very diverse interests. “We have a lot of engineers, a lot of people with IT expertise and fintech knowledge. We do medical diagnostics and devices, but not as much as we used to because the exit is getting harder” in that field. “We will not do drugs … it’s just too capital-intensive. … We love high-growth [Software as a Service] businesses. Our group is not so consumer-facing” because the cost to build a brand and launch a product is too high.

The best way to approach Jumpstart is through a warm introduction, she added. So if you know an attorney or accountant or “one of the people we deal with at an economic development” group, have them make the introduction. “We do have an event called ‘Meet the Angels’ three times a year where we invite companies in to have a drink with us.”

Advice: “Every early-stage company needs persistence. This is hard work. You are going to get ‘no’ more than you are going to get ‘yes,’ but you will find the right person somewhere along the way,” and you’ll get introductions. This is a very open community, and they’ll say ‘you should talk to so and so.’ Talk to them. You never know.”

John Pearlstein

Robin Hood Ventures (Philadelphia) was started in 1999, John Pearlstein told the assembled entrepreneurs. “We’ve invested in over 60 early-stage growth startups. We invest between $250,000 and a million dollars per deal,” and fund two or three add-ons as well. “We typically invest $2.5 to $3 million per year.” Robin Hood has a lot of retired entrepreneurs as part of the group. “But we are up to 44 members.”

The angel group likes deals in information tech, healthcare, physical sciences and life sciences. “We feel good about this because we are diverse and have expertise in all these areas,” Pearlstein said. This is also good for the entrepreneurs because when their business model evolves, there are people there to help them, he said.

Like some other angel groups, Robin Hood wants startup entrepreneurs to apply online, fill out their forms and provide the appropriate information. “That will then be gleaned and screened by our administrative staff.” Next, the members hold conference calls to decide which deals they think are interesting and whom they want to bring in for a presentation. There are two to four presentations at each monthly meeting.

“We’ll give you feedback right after the meeting, whether we are going to go to due diligence, whether we think it’s not fundable, or whether we think you are just too early.” Robin Hood has also created a smaller fund for very early companies, to provide $25,000 “for those companies that just need to go to that next level, so that they will be ready for angel funding.”

Advice: “Your presentation shouldn’t create more questions than it answers. Also, as a company you always need to adapt, not only to changing conditions, but also, your deal sheet might not be acceptable, so, therefore, your ability to adapt is important to move forward.”