Opinion: Apply for the New Jersey EDA’s Net Operating Loss Program By Sept. 30 —It’s Like Found Money

Each year I plead with the New Jersey startup community to take a look at a program from the State of New Jersey that will give not-yet-profitable tech and life-science startups an average of $1 million in undiluted cash to do with as they please: plow it into R&D, hire more people or finance new equipment.

The bottom line of the Technology Business Tax Certificate Transfer (NOL) Program is that local startups that have intellectual property are allowed to sell their R&D tax credits or their state tax losses to companies, like PSE&G, that need tax breaks. There is $60 million set aside for this program.

So now you know the catch: You must have intellectual property to qualify. Another requirement is that you cannot have had any net operating income during the past two full years; this also applies to any entity that owns or controls at least 50% of your company, whether directly or indirectly. And there is a minimum and maximum number of employees that you can have, depending on how long you have been in business.

If you are interested in the NOL program, don’t plan on moving out of New Jersey any time soon. The state will recapture the money if you do.

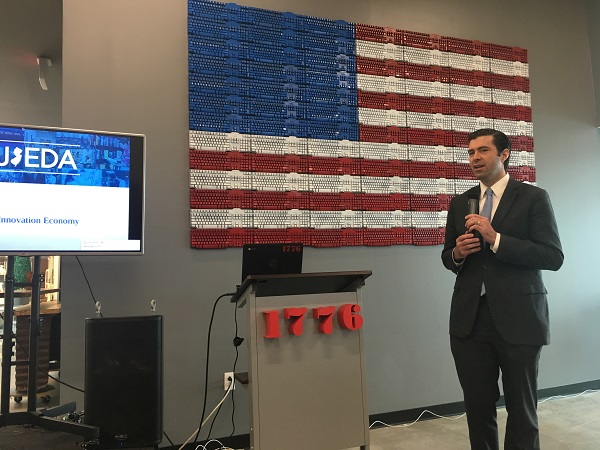

The New Jersey Economic Development Authority (EDA) is accepting applications online for this year’s NOL program. The deadline this year has been extended to Sept. 30, 2020. That’s right around the corner.

“Creating a stronger innovation economy in New Jersey means creating a pathway for early-stage technology and life sciences companies to continue research or operations before they reach the point of profitability,” said Tim Sullivan, CEO of the EDA. “The NOL Program is helping to cultivate the growth of this vital sector and spur the creation of even more New Jersey success stories.”

New Jersey startups that have taken advantage of the R&D tax credit have nothing but good things to say about it. If you fit this program, you should go for it! Don’t wait until the last minute to look into the program. There are criteria you must meet and paperwork you must file. You also must get your tax returns done and find a buyer for your credits. The EDA will help there.