Will NJ’s Angel Investment Tax Credit Free up More Money for Tech Startups?

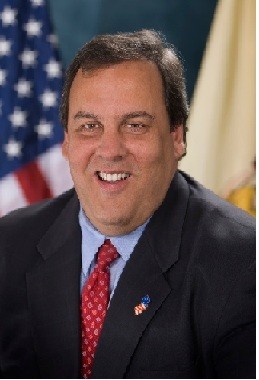

In a move that angels and startups alike are saying has the potential to motivate Garden State investors to open up their checkbooks, Gov. Chris Christie has signed a bill creating an angel investment tax credit program.

The bill, known as the New Jersey Angel Investor Tax Credit Act (S-581), provides tax credits for up to 10 percent of a qualified investment in an emerging technology business with a physical presence in N.J. Companies must conduct research or manufacturing, or provide technology commercialization within the state to qualify.

In a statement, Christie said he believed the tax credit program would spur job growth in the Garden State. He added that to secure the state’s leadership in cornerstone industries like pharmaceuticals, life sciences and information technology, the state “must have policies that support New Jersey’s own startups in these fields.”

Qualified businesses — the startups to be invested in — must have 225 employees or fewer, with 75 percent of them filling positions in New Jersey, and operate in the following fields: advanced computing, advanced materials, biotechnology, electronic device technology, information technology, life sciences, medical device technology, mobile communications technology and renewable energy technology.

In addition, the businesses must meet one of the following work or research criteria: have qualified expenses paid or incurred for research conducted in New Jersey, or conduct pilot-scale manufacturing in the state or conduct technology commercialization here.

Credits will be capped at $500,000 for each qualified investment, and the total program is subject to an annual cap of $25 million.

The New Jersey Business and Industry Association (NJBIA) (Trenton) said it had been pushing for such a bill for a while. “We need to create an environment where innovation and technology companies can thrive,” Philip Kirschner, president, said in a statement.

“This is great news for the angel investor community in New Jersey as well as seed and early-stage companies,” said Mario Casabona, founder and general partner of TechLaunch (Montclair), the tech accelerator partially sponsored by the state. “This bill, along with others that Gov. Christie … recently signed … will provide much-needed incentives for investors and entrepreneurs to build and stay in New Jersey.”

Added Katherine O’Neill, executive director of Jumpstart NJ Angel Network (Mount Laurel), “Jumpstart … welcomes Gov. Christie’s support for the early-stage technology community. The angel tax credit bill will further encourage investment and job creation in new and emerging companies. This bill puts N.J. in the forefront of supporting early-stage investments in growing companies.”

“The technology community salutes the governor and legislators for seeing the value of this ecosystem and supporting it with tangible assistance to encourage more startup and growing companies by providing credits for investors. The Angel Investor Tax Credit program shows New Jersey is a leader in encouraging innovation,” she concluded.

Jay Trien, CPA, Venture Association of New Jersey founder and president and a partner at Raich Ende Malter & Co. (Chatham, N.J.), said the New Jersey Angel Tax Credit Act is a good first step but pales in comparison with the breaks other states are giving their angel investors. “It’s great that Christie agreed to this; however, some states, like Hawaii, offer 100 percent credits, and nearby Connecticut gives their angel investors a 25 percent credit,” he noted.

Trien said there may be issues involving who is qualified to take the credit: “As a practical matter, these things are never simple. If you are going to get an investment tax credit of 10 percent but it costs you half of that to figure out if you are legally qualified to take it, it’s often too much of a hassle.”

“I think it’s wrong for any government to try allocating capital by choosing which industries are winners and [which are] losers. However, since other states are doing this, N.J. is forced to implement these kinds of laws to be competitive,” he indicated.

One skeptic about the new law, Kuratur (Red Bank) founder and serial entrepreneur Kirsten Lambertsen, said in an email interview, “I don’t expect it to move the needle that much.” Kuratur provides a service that allows content providers to publish a web magazine in minutes.

Speaking as a businessperson in the thick of fundraising through angels, Lambertsen said angels who employ an investing thesis (such as “I invest in social local mobile that gives back to the community,” for example) and invest the same amount in a fairly set number of startups each year might increase that amount as a result of the tax credit. Angels who don’t use such an approach might be motivated to invest a little more in one or two more startups.

Noted Lambertsen, “The issue is that angels seem a bit overwhelmed by the startup tsunami going on right now. While you might think increased deal flow would lead to increased investing, I think the reverse is true to an extent. So while I’m sure the tax credit will increase angel investing somewhat, I’m not convinced it will unleash an exciting new era in funding for very early-stage startups. I’d love to be wrong.”