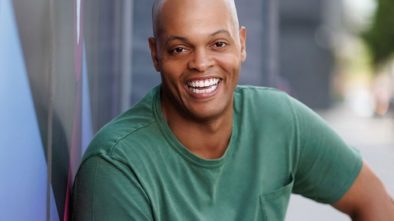

At the 100th NJ Tech Meetup, Stevens Alum Manny Medina Talks about Raising Funds for Startups

By Rob Rinderman

“A lot of capital raising requires a mindset that you are going to make it with or without them [prospective investors],” Manny Medina, cofounder and CEO of leading sales-engagement platform Outreach (Seattle), told an audience last week at the 100th NJ Tech Meetup.

Outreach strives to create a better automated process for improved performance by an organization’s sales reps. It is essentially an engine that personalizes outbound emails and the follow-up processes.

The meeting, which took place at Stevens Institute of Technology (Hoboken), was hosted by assistant meetup organizer Edan Golomb, who also moderated the fireside chat with Medina, as meetup founder Aaron Price was unable to attend.

Medina, who was one of the first few employees of Amazon and also served as director of business development at Microsoft, has an MBA from Harvard, a master’s degree in computer science from the University of Pennsylvania and a bachelor’s degree in computer engineering from Stevens. He also participated in the 2011 class of Techstars, the renowned startup accelerator program.

Outreach has completed multiple funding rounds on behalf of its supportive early angel investors. Medina said that their cap table contains more than 60 people, including the initial 40, who invested less than $20,000 each.

Along the way, a number of savvy VC firms became investors, happy to participate in the organization’s upward trajectory. According to Crunchbase, the company has raised $125 million via seven funding rounds. Outreach currently employs about 315 people and serves around 3,200 customers.

Coming to America

Not bad for an Ecuadorian entrepreneur who initially immigrated to the United States at the age of 20. Ironically, his port of entry was Newark, just a stone’s throw from Hoboken and the Stevens campus.

Medina freely admits that none of his corporate success would have been possible in his homeland. “I come from a communist family where working for the government was considered a success,” he said.

In fact, Medina was celebrated for exhibiting an audacious, capitalistic style and swagger back in 2015. Leading a startup company that at the time was on the verge of bankruptcy, and with essentially nothing to lose, he reluctantly hit the road to pitch VCs. He utilized a daring, one-slide deck labeled “MRR,” an abbreviation for the business’s “monthly recurring revenue.”

Pitching VCs

During this freshman foray into pitching to the VC community, Medina made a point of introducing Outreach by simply stating, “We sell to sales people. … Any questions?”

Midway through those initial meetings, he would dramatically refresh the chart, which was connected to the company’s Recurly subscription-management, payment and billing services account, and slyly apologized for the changes in the numbers, noting that the MRR level had in fact moved northward while they were chatting together.

The strategy ultimately worked. Outreach banked a $2.3 million seed round, followed by a Series A that brought in four times that amount.

Also in 2015, the research firm CB Insights published a forecast that Outreach would be one of 50 companies to eventually reach unicorn status (i.e., valued at $1 billion or higher). Note that 48 percent have already achieved this exalted status during the subsequent four-year period.

An Unusual Founding Story

Interestingly, Outreach originally rose from the ashes of a failed recruitment firm called “GroupTalent” (Seattle), which Medina and his fellow cofounders built to create perfect matches between job hunters and businesses in need of staff.

In the process of attempting to sell their way out of a deepening hole, the team developed a product that created a workflow which enabled them to sell faster, more efficiently and, most importantly, more effectively, he said.

Although their customers had previously shown tepid interest in the talent recruitment offering, they were very interested in learning how GroupTalent was so adept at arranging many meetings at lightning speed, in addition to the company’s skill in accurately targeting prospective clients.

Once the lightbulb came on, and the GroupTalent team realized that customers were seeking a better way to sell, the team understood that their future prospects were directly tied to this directional pivot. As they were product-centric people, building, marketing and selling these products has proven to be the key to their success.

In its first six months of operations, Outreach generated its first million dollars in Software-as-a-Service (SaaS) sales, and the company never looked back.

Additional Insights

Some additional thoughts and insights provided by Medina during the chat:

- As a founder, you should go out and sell your product or service before bringing in any outside salespeople. Outreach didn’t hire salespeople until it had achieved a recurring revenue of $1 million.

- The startup’s first two outside hires were team members focused on customer success.

- Finding a product/market fit is the most important metric for your organization.

- Raising prices isn’t necessarily a risky proposition if you have the right product/service. Outreach raised its minimum prices per enterprise several times before hitting a level where they began to receive client pushback.

- The top 5 percent of businesses typically retain 80 percent or more of their customers.

- “I miss the early days,” Medina said, referring to a time when the company could sell to different types of clients. But with exponential growth, you need to focus on better targeting your resources, he added.

- Don’t believe a lot of what you read on the internet. Much of it comes from people who have never built a business themselves.

- Early-stage founders should hire door openers ― people who can set up appointments with top execs. Medina feels this ability is one of his core strengths.

- In the early days, you should hire generalists. The top producers won’t want to work for you until you’re more established, anyway.

- Many successful organizations, Outreach included, seem to sputter a bit at the $5 million to $7 million sales level, for whatever reason. You will have to replace many of your go-to-market team members at that point, an important move if you want to get to $10 million or more. It’s not easy to fire employees at this point, but it’s a necessary evil.

- Series B investors spend much of their time telling others how good your company is and what a good decision they made.

- Series C investors will come to you with capital when you get to the level of success they’re seeking.

- Successful founders must be prepared to be laser-focused on their businesses, and to budget their time appropriately. Families often suffer. Medina brought his daughter with him on a trip to the East Coast, and promised to take her to see the Broadway show “Hamilton.”